How Much Do Apps Charge For Advertising

Research from iPropertyManagement.com reveals the typical monthly management fee of U.S. residential property managers in 2019. Read further to learn more about how property managers charge for their services and what red flags to look out for.

8-10%

*Typical monthly management fee for residential, but can vary greatly by property, location & offering.

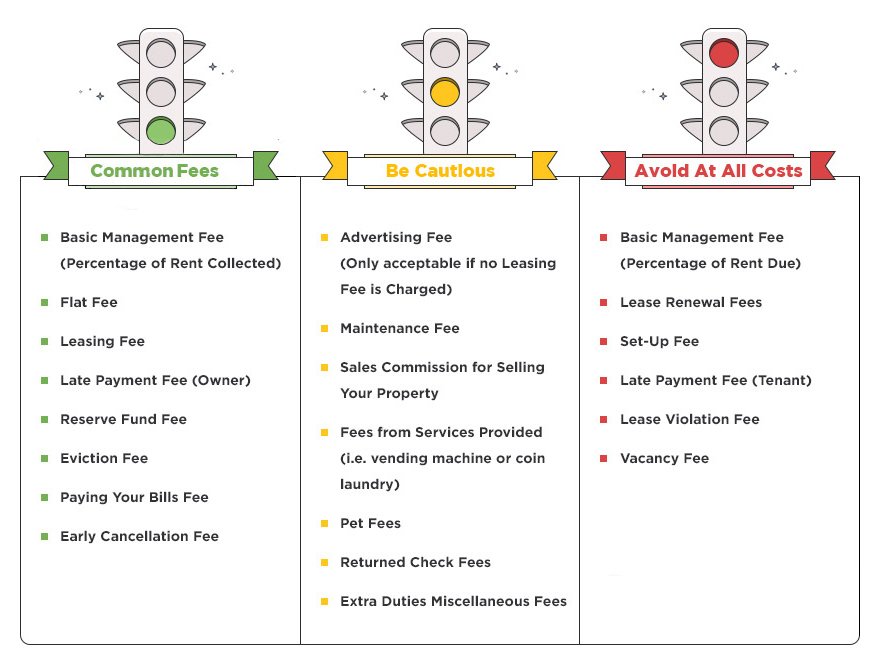

Since property managers vary greatly in HOW they charge for their services, we created a fast fact sheet below for what you should look out for. Read further to learn more about how to assess different types of fees property managers charge.

The Standard Property Management Fees

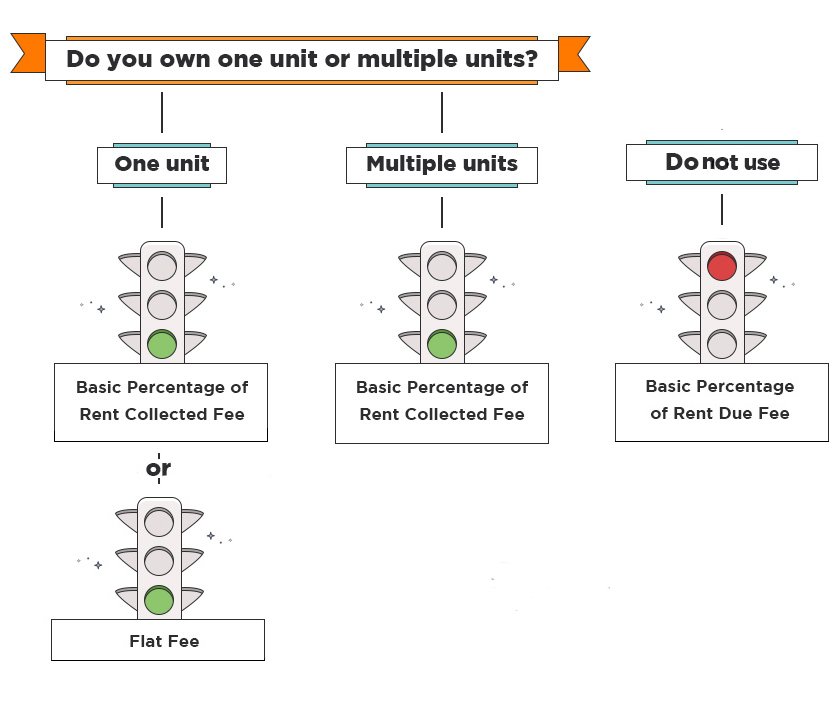

Management fees come in two forms: a basic percentage of rent fee and a flat rate. Sometimes, they charge you a combination rate. A combination rate means they charge you a percentage of rent fee or a flat fee, depending on which is more/less.

Basic Fees

Basic fees are usually 6-12 percent of the rental property's monthly rent. These fees can depend on whether it is a commercial or residential property and the property type (i.e. apartment, condo, townhouse, etc.). This is a wide range, but it can be broken down further. If you give the property manager a single-family home to manage, or a few units within a building, the rate will be closer to 12 percent. If you've tasked the property manager with a full building you own with many units inside or with a large portfolio, it will be closer to 6 percent. The more business you are giving the manager, the more generous the rate will be.

However, you only pay that amount if the property management company successfully collected rent. Collecting rent is tough, but since your property manager has an incentive to collect, you know they will be doing everything possible to make sure the unit is occupied and paying on time.

Basic fees are also known as percentage of rent fees and percentage-based fees.

There are two ways that the percentage of rent fee can be worded in your contract. While the differences in language are minimal, they make a big impact on how much you pay and how your property management company will perform.

Percentage of Rent Due: You want to avoid this language in your contract. This means your property management company gets paid the same amount every month regardless of whether your unit is occupied. It is a bad deal.

The percentage of the month's rent is 10 percent. You charge $1,000 for a tenant to rent your property for a month. You pay the property management company $100 every month, even if there isn't a tenant in the property. This can also be called percentage of scheduled rent.

Percentage of Rent Collected: This is the ideal way to pay your property management company. This means that your property management company only gets paid if your unit is occupied. It is a good deal.

You normally pay your property management company $100 a month when your unit is occupied. However, when your property is vacant, you don't pay your property management company for the time.

This provision encourages your property management company to do their job. They'll do their best to keep your tenants happy because it is in their best interest for your tenants to keep being your tenant. Also, at times tenants can be reluctant to pay rent. Your property management company will work harder to collect rent from tenants if their paycheck depends on it. They'll also work harder to fill vacancies quicker.

Basic fees are usually good deals for investors with many units and can be good or bad deals for those with few units. If you have few units, look into companies that charge both types of fees. If you find a company that charges a flat fee that turns out to be a smaller percentage of rent than a company that charges a basic fee, choose the company with the flat fee company and vice versa.

Flat Fees

A flat fee means that everyone is charged the same amount no matter how much business they give the property manager.

Jim owns an apartment complex and wants Company X to manage the units inside. The building has 12 units and Company X charges a flat fee of $50 per unit. That means that Jim would need to pay $600 a month to manage his units. Jim rents his units for $500 a month. Which means a $50 flat fee is 10 percent of what he earns from rent.

Flat fees are usually bad deals for investors with many units.

At a company that charges a basic fee, Jim might have gotten a rate as low as 6 percent, but definitely lower than 10 percent. If Jim was using a basic fee at 6 percent per month, he would pay only $360 per month. That's $140 less than he was paying with the flat fee property management company.

Ashley owns one single-family home. She is also looking into using Company X. Since she has just one unit, she pays Company X $50 a month to manage her property. Ashley also rents her unit for $500 a month. Which means the $50 flat fee is 10 percent of what they earn from rent.

Flat fees are good deals for those with few units.

For a single-family home, 10 percent is a standard fee for a property management company to charge. It's actually better than some other companies Ashley might have found. However, Jim is giving the Company X good business.

Some landlords consider flat fees to be a better deal than basic fees, especially for units that are pricey. They do not think it is fair to pay a larger amount to a property management company.

Ashley owns a very nice beachfront property in Florida. She rents it out for $2,000 a month. A flat fee company in the area charges her $50 a month to manage the apartment. However, a company that charges her a basic fee could charge anywhere from 6-12 percent of the rent, depending on how many other properties they manage for her. That's anywhere between $120 and $240. In this scenario, it makes sense for Ashley to use the flat fee company. It is in most cases like this. A flat fee company charges Ashley the same amount to manage her property as they would to manage a property that only earns $500 a month in rent.

Flat fees are good deals for investors who rent out expensive properties. They are okay deals for investors who rent out inexpensive properties.

Which Property Manager is Best for You?

Of course, you should shop around with different companies that manage properties in your area, but beware of companies who charge far less than the norm. You might feel you're getting more bang for your buck with a company charging you 4 percent in a market where 8 percent is standard. However, how can this company afford to charge so much less than the others? Is their quality of service lesser than other property management companies? While you may be paying half the cost of property management fees, you might end up making 100 percent less in rent for longer periods of time.

A company that charges you less overall may recoup the cost by charging you for every action on your property. Those fees can rack up quicker than you would think. You have to decide what property management services your rental business needs the most.

Á La Carte Property Management Fees

Most companies charge you additional fees for certain management services they must perform. For instance, a property manager may charge you extra to fill a vacancy or conduct tenant screening. If your property management company is charging you for a bunch of these services upfront, be careful. This is common for companies that charge much lower rates than competitors. If the price is your number one concern, consider these fees before partnering with any property management company. However, sometimes companies will offer you one-time services for a flat fee if you need particular assistance.

Leasing Fee – Good Deal

Leasing fees are common; however, you should negotiate them. It is charged to you by the property management company when they need to fill a vacancy (i.e. when one of your units is vacant). They are also known as placement fees. They can be expensive, depending on the economic market, demand for housing and how much work the property management company believes it costs them to fill a vacancy.

The leasing fee can get very costly if a company charges every time they find you a new tenant.

Consider this: why would your property management company aim for a long-term tenant, if they get paid a bonus each time they have to find you a new one?

The property management company uses the leasing fee to pay for filling the vacancy. Those expenses include a real estate agent's commission, advertising, showing the unit and other expenses that come with trying to fill a vacancy.

It's unlikely that you will find a property management company that doesn't charge a leasing fee, but that doesn't mean you have to take the loss. Add these provisions to the contract:

- Set the leasing fee to a certain amount. Meaning, the property management company earns the same amount of money whether it takes them one week or three months to fill the vacancy.

- Work in an incentive for finding long-term tenants. For example, a full or partial refund if the tenant is evicted or breaks the lease within a year of when they move in or insist they can only charge the leasing fee once a year.

- Add a provision that if you find a new tenant yourself, you don't have to pay the leasing fee. This will encourage them to quickly find a new tenant.

- Make sure they work their advertising budget into the present leasing fee. Some property management companies charge advertising fees. Otherwise, it's as if you're getting charged twice for the same service. Additionally, you shouldn't really be responsible if they advertise poorly. You don't want to keep getting charged for ad space because their first try didn't cut it.

If you negotiate correctly, the leasing fee should be a good deal. It should be money well spent with a high return on investment. However, if you don't negotiate the above stipulations, it could be a very bad deal.

Vacancy Fee – Bad Deal

Vacancy fees are uncommon. If your property management company specifies a vacancy fee in your contract, make sure that the contract also says how they plan to use that money to help fill the vacancy. If they don't have a good reason for collecting it, like those listed above, you may want to reevaluate whether this company has your best interest in mind.

A vacancy fee can be one month's commission up front or another amount specified in your contract.

Vacancy feels are usually bad deals. However, if the management company provides you with a good reason for charging it, it shouldn't be a dealbreaker.

A company that uses the percentage of rent collected basic fee is more likely to charge you this type of fee, as they are not collecting revenue from you during times of vacancy. If a property manager using any other type of management fee charges you a vacancy fee, it is likely a bad deal.

Typically, money collected from vacancy fees is just to recoup the lost revenue from the monthly flat fee or base fee. Most property managers don't use it to fill the vacancy. Leasing fees fill this role. If the company, doesn't charge a leasing fee, they might be using the vacancy fee for its purpose.

Advertising Fee – Okay Deal

As listed in the section about leasing fees, your property management company might charge an advertising fee. While you should work to combine the advertising fee with the leasing fee, sometimes you may not have to pay a leasing fee at all. In that case, an advertising fee would be reasonable. It wouldn't be fair for your property management company to be shelling out the cost of advertising your unit.

However, make sure your contract states how much they will spend on advertising and in what cases they will need to spend more. Make sure that includes how they will market your property through free channels as well. There are many free online property advertisement websites they should be taking advantage of.

That doesn't mean they should be using them instead of advertisement because the sooner your unit is filled the better, but a nice combination can save you time and money. You never know where your next tenant will come from.

A property management company can use your fee to promote your unit on social media, in local publications and on the MLS. Boosted social media posts are a great way to reach potential tenants because the advertisement is slipped between posts they are already actively engaged with. The MLS reaches realtors who might be looking for a property for their clients. And local publications are a traditional spot for tenants to seek out listings.

An advertising fee is a good deal if you're not being charged a leasing fee and if your property manager is efficiently advertising.

Lease Renewals – Bad Deal

Your company might ask you to pay for the paperwork they need to create to renew a lease. However, the documents are standard and they've likely created them already for other clients. While it does take some time to change the names, dates, and addresses on the paperwork, it shouldn't take them more than an hour of one employee's time.

Try to negotiate away from paying this fee, but if you must pay, make sure the fee is nominal. Paying more than a nominal lease renewal fee is a bad deal.

If it is a large fee, consider how much you're paying in other fees. Is it worth it for you to be using a company that is nickel and diming you for lease renewals? It depends on what they're charging you for other fees. You might overlook a company charging a lease renewal fee if other fees are scarce. However, be wary of companies charging you every fee on this list.

Reserve Fund Fee – Good Deal

Sometimes emergency expenses happen. There might be a leak in your unit or the A/C might stop working. A tenant living more than a reasonable amount of time without cooling in the summer or heat in the winter will not likely renew their lease with you.

If your property management company is trying to contact you to get the money to make this kind of repair, it could lengthen the process. That's why many companies will charge you a reserve fund fee. The fee gives them money they can hang on to in the case of such an emergency so they can fix the damage as soon as possible.

Paying a reserve fund fee is a good deal. It's like storing your money in a bank that doesn't bear interest. You would have needed to pay for the repair regardless.

Talk to your property management company about whether the reserve fund fee is refundable. In the case that your property manager did not use your reserve fund fee and you no longer retain them as your property manager, you should be entitled to the money they were holding. However, make sure that it is stated in the contract. If you are severing ties with a property manager, they might fight to keep every penny.

Paying Your Bills Fee – Good Deal

While this fee may be listed under many names in your contract, it is a convenient service. Companies that charge this fee will take care of paying your mortgage, insurance, association fees and more for you. They will likely charge a small fee for the service; however, if you've got a lot on your plate, this is a good deal. In the long-run, you might save money on late payment fees.

These fees are usually small, about 1.5 percent of the money you needed to pay. These are also known as unpaid invoice fees.

Set-up Fee – Bad Deal

Some companies will charge you to set up an account with them. They are also known as onboarding fees. They range from $0-300. It is important to clarify if the onboarding fee is charged once for your entire portfolio or if it is per unit.

These fees are usually bad deals. These are most typical among companies that charge lower management fees than their competitors, as they are trying to recoup costs in other ways.

If your units are occupied, you should try to get the property management company to lower the fee. When the property management company isn't going through the trouble of renting the unit, setting up your account shouldn't be difficult or expensive.

Eviction Fee – Good Deal

Most states have laws that make it mandatory for evictions to go through the court. If one of your tenants is evicted you will be expected to cover the court fees and, possibly a sheriff's fee. Sometimes, even after an eviction, your tenant will not leave your property. In many states, you cannot legally remove your tenant's belongings from the unit on your own. However, if your tenant has been evicted a sheriff can escort you to do so. You do have to pay the sheriff's hourly rate.

Additionally, filing the paperwork and posting notices takes time and is stressful. Your property management company will likely charge you an additional eviction fee.

An eviction fee is a good deal. Your property manager will need to spend a decent amount of money to evict one of your tenants. Additionally, evictions are a big hassle and your property manager will have definitely worked hard for the money.

Late Payment Fee – Good Deal

Your property management company may charge you a fee for paying late for any work they have done. This fee is reasonable and, as long as you pay on time, avoidable.

Just as you expect the property manager to collect rent from your tenants on time for you, they will depend on you to pay the applicable fees on time. It is important to pay when you're supposed to. Your property manager depends on that money to continue performing services for you. Not paying on time can jeopardize their quality of work too.

Maintenance Fee – Okay Deal

Some companies charge you a maintenance fee because they have a repair crew on retainer. That means that they pay a maintenance crew to always be available when an emergency job comes up. As mentioned in the reserve fund fee section, emergencies happen. It can take time to find someone to do a job on short notice. More so, the person they find may not be the best person for the job. That means that whatever is fixed may not be fixed for long. It can cost you more in the long-run to have someone unreliable make a repair than someone costlier, but professional.

By having their own team on call, your property management company can make sure that the right person repairs your unit every time. For that reason, this is an okay deal. While the service is convenient, it is an uncommon fee. Most property management companies get the job done without charging this fee. It's okay for you to sign with a property manager that charges it, just make sure that you're being charged a reasonable amount for it.

Just because you're charged a monthly maintenance fee, doesn't mean the work done will be free. The maintenance fee is used to make sure a crew is there when you need them to be, 24 hours a day, 365 days a year. Even after a hurricane when everyone needs repair work done or during the holidays when they want to be home with family.

You will need to pay the employees an hourly rate to actually make the repairs when the time comes. Find out how much the hourly rate will be for each repair. Is this crew also used for larger scale repairs and remodeling? For larger projects, are rates comparable to outside contractors?

It's also important to confirm that the rates will not change during holidays as you're paying the maintenance fee for that. The company may charge for trips that are false alarms, but you should include contract language that states those payments are the responsibility of the property manager. The maintenance crew shouldn't be charging a trip fee if they stay to make the repair.

Additionally, the crew is there on normal days when demand is low to make repairs as deemed necessary by the property management company. Talk to your property management company first to confirm what repairs they will make.

You can possibly negotiate your way out of paying this fee, but you won't have the luxury of having the crew in emergency situations when demand is high.

Commission for Selling Your Property – Okay Deal

Should you choose to sell your property while under contract with a property management company, the company may require you to give them the right to sell it, and/or give them the commission for selling it. Meaning, even if you sell it with a different broker, they might take the commission.

This is an okay deal. If your property management company wants the commission for selling the property, don't list it with a different broker. List it with the property manager and give them a timeline to sell. Include that timeline in the contract.

For example: The company needs to sell the property by the time the contract would have normally ended or within (x) months of you listing the property with them.

At that point, you can list it with whoever you want. Additionally, you could just wait until your contract is done to sell the property.

If you're desperate to sell, and you don't think that your property manager will be able to do the job, you can list your property with whatever broker you want and pay both brokers the commission. However, this is a bad deal. You will have to pay commission to at least two and possibly three realtors, which could equal as much as 9 percent.

Make sure that commission is specified in the contract. It should be no more than 6 percent. If your property manager works with another realtor – the buyer's agent, your property manager should receive no more than 3 percent commission. The other realtor will receive the same. If you can negotiate a lower commission, it becomes a better deal, but 3 percent each for a total of 6 percent is very standard.

Early Cancellation Fee – Good Deal

You might sign a contract with a company and not be satisfied with their work. You might feel they overcharged you for a repair or that they are taking too long to fill your vacant unit.

Whatever the reason, you may want to switch property management companies and that is okay. However, your property management company will most likely charge you some sort of fee for canceling sooner than stated in your contract.

This fee is not a dealbreaker. It is a completely avoidable fee, too. Just like you would penalize a tenant for breaking a contract with you, it makes sense for the property manager to penalize you.

Other Methods Your Property Management Company Can Use to Collect Revenue

There are other fees that your tenant pays that your property management company might try to take a percentage of. Usually, they are bad deals, but that doesn't mean you should run because of them.

Tenant Late Payment Fees – Bad Deal

Letting your property manager take commission from a late payment fee is a bad deal, avoid it at all costs. Your tenant pays a late payment fee as a penalty for paying you late. It is supposed to deter the behavior from happening again.

At the same time, it is your property manager's job to collect rent on time. If your property manager doesn't collect rent on time, there's actually no penalty; although arguably there should be. However, if your property manager receives the commission from a tenant's late payment fee, they're actually being rewarded for not doing their job.

What motivation does your property manager have to encourage on-time payment, if they make more money from late payment?

Commission from a late payment fee is a dealbreaker. If your property manager insists, walk away from the contract.

Lease Violation Fees – Bad Deal

Similar to the tenant's late payment fees, charging a lease violation fee to your tenant is a penalty. You are penalizing the tenant for violating a lease they are contractually obligated to follow. It is the property management company's responsibility to make sure your tenant follows the lease.

You are being hurt because your tenant does not follow the lease. You could lose money or suffer property damages. You are entitled to the revenue generated by lease violations.

Just like with late payment fees, your property manager shouldn't be rewarded because they inefficiently managed your tenant. Otherwise, there would be no reason for your property manager to discourage lease violations. If a manager wants to charge you a lease violation fee, it is a bad deal.

Fees From Services Provided – Okay Deal

Your unit(s) may have a vending machine or coin laundry service. It is an okay deal for your property manager to take a portion of the revenue.

What it comes down to is: who pays for the services provided? Do you pay for the electricity that runs the vending machine and laundry? Do you pay for the water that's used in the laundry machine? Who pays for the repair of those products? Who empties out the coins? If the answer is you, you should keep the full profit. Otherwise, it's okay for the property manager to take a proportionate commission of the profit based on how much work they do.

Pet Fees – Okay Deal

Accepting pets at your property might bring you more tenants looking to rent from you, but at the same time, that pet might cause damages. That's why pet fees are collected from tenants. Your property manager may try to collect tuition from that pet fee. It is an okay deal to let your property manager take commission from the pet fees.

On the one hand, your property manager is responsible for making repairs and the pet fees could help cover that cost. However, they are likely already collecting maintenance fees from you. Your property manager is responsible for maintaining the property as part of the management fee too. But again, the pet may create additional work for the property manager extra work.

Your best bet is to have the property manager hold on to the money, whether it is a deposit or monthly fee so that they can use it to make needed repairs to pet damage – the purpose of the money.

If it is a deposit, any unused money needs to go back to the tenant. If it is a monthly fee, your manager should hold the money for a set period of time in case of large-scale repairs.

You hold the money until you have $500 saved up for repairs. Any money accrued after that can be distributed to you as profit. If any of the money is used, the pet fee should replenish the fund, not serve as profit. At that point, you can choose whether paying the property manager any commission is fair.

Returned Check Fees – Okay Deal

Returned check fees are supposed to cover the cost of a bounced check, usually around $35. If your property manager is responsible for cashing checks and they were charged the fee, then they should receive the money. If you were charged the fee, you should be given the cash.

If you're collecting more than the cost as a penalty you should probably receive the extra money. If your property manager wants the commission, it's kind of a weird deal. There's no reason your property manager should really be getting a commission as there isn't much money to be made here.

If your property manager paid the cash for the bounced check and has to return to the bank to cash the new check, you might want to give payment for the extra work. However, that's up to you because it is technically part of their normal responsibility. If you do render payment/commission to the property manager, it should not be a lot.

Some property management companies choose to provide a list of services they do not provide under the fees you regularly pay and how much they charge to perform those services.

These usually are not services property managers typically perform. They are likely extra services that you might ask them to perform.

These are okay deals. The point is that these fees are extra things you will not really need. However, if you feel the list includes services that a property manager should perform, use your discretion and negotiate the fee.

Do Your Research

You should always ask how many property managers a company has on staff. A typical property manager can manage 30 units at a time. Therefore, you want to be sure the company has a big enough staff to handle the number of units they currently have, plus yours. Otherwise, you might be getting a great rate, but sub-par service because the manager doesn't have enough time to give your property the attention it needs.

The exact amount that a property management company will charge you for the above fees depends on a lot of factors: where you live, how much the property is worth, how much you charge each month. It makes sense that prices differ because situations differ too, even within the same property management company.

It might be easier to find a tenant in Miami, Florida than it is in Rochester, New York. However, a handyman's repair might be cheaper in Rochester than it is in Miami. A company may give you a better rate per unit if you let them manage multiple units. It varies.

Call multiple property management companies and write down what they charge for each of the above fees. Download and fill out the A-Z List of Information to Get from Property Managers About Fees to compare the companies you have in mind. Check out our guide on further researching property management companies for a list of questions to ask the property manager while you have them on the phone.

You can find a list of property management companies on our site complete with reviews and information to help you make an informed decision about which company is right for you.

Above all, make sure the company's goals align with yours. Is their priority making a profit or effectively managing your property? You want to work with a company that realizes effectively managing your property is a great way to keep your business and obtain new business. You want a company that knows choosing great tenants ensures they do less work and collect continuous management fees. Therefore, effectively managing your property should be how they aim to make a profit.

How Much Do Apps Charge For Advertising

Source: https://ipropertymanagement.com/property-management-fees

Posted by: deckertoomeng.blogspot.com

0 Response to "How Much Do Apps Charge For Advertising"

Post a Comment